The average holiday of £2,417 would cost £805 over three months with Klarna's pay in three option on Expedia, compared with £205 a month with a 12 month 0% credit card, which also gives you the added flexibility of allowing you to shop around for the best price for your trip.

Instead, you might be better off with a 0% credit card, whichgives you more breathing room to spread the cost of a large purchase like a holiday by up to 26 months. When using Klarna to pay for flights you must make sure you can pay for the total transaction in a relatively short amount of time.Īs payments are taken automatically on the due date, you won't be able to prioritise other important payments such as rent or council tax, which could mean you may turn to other quick high-cost credit to cover the shortfall, such as a payday loan or an overdraft. Klarna and other 'buy now pay later' firms such as Clearpay and Laybuy offer more flexibility at the checkout, but could tempt you to spend more than you would. Should you use Klarna to pay for your next holiday? However, Klarna does offers its own buyer protection policy, and you may be able to make a Section 75 claim if you use a credit card to pay off the outstanding debts. This means Section 75 protection, which applies on purchases of between £100 and £30,000 on credit cards, won't apply if the holiday firm goes bust. Klarna's pay in three instalments scheme is not regulated by the Consumer Credit Act. What are your rights if a firm goes bust? Find out more: 44 tips to getting out of debt.They will record this information on your credit report which could impact your credit score and your ability to borrow in the future for a mortgage or a credit card. Klarna will also report any failure to pay to credit reference agencies. If you are in default, Klarna may also charge the outstanding balance on your 'pay later in three instalments' purchase immediately, using any card it has on file for you. If you fail to make a payment Klarna may continue to attempt to collect the overdue and most recent bill on at later due dates. So you will need to ensure you have the funds available to cover the payments on the due dates. Klarna will take the money it's owed automatically from a nominated credit or debit card.

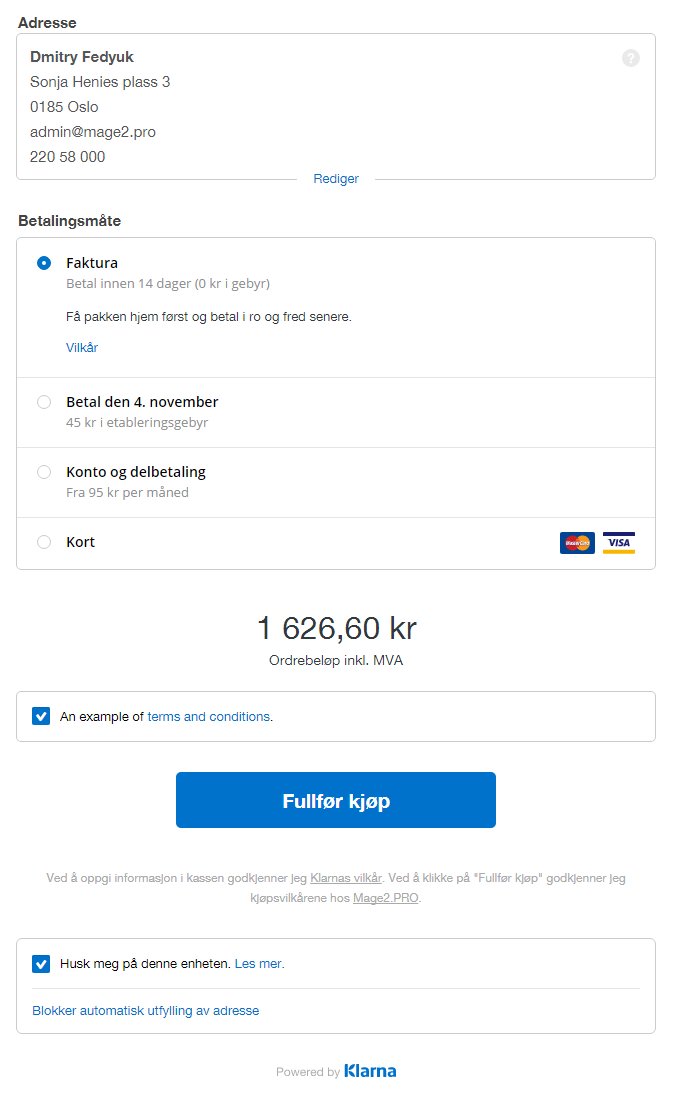

Find out more: the best and worst travel agents.The payments are interest-free, but they are taken automatically from your nominated debit or credit card on the due date, whether you have the money or not. If approved, you'll pay three lots of £631: the first payment is up front, the second 30 days later and the third and final payment 60 days later. Klarna will do a soft credit check with a credit reference agency that won't impact your credit score. Taking Expedia as an example, we found that you could opt to pay for return flights for four adults from London to Vancouver worth £1,893 in three instalments with Klarna. Find out more: best debit cards to use abroad.Last year Expedia's research found the average trip cost £2,417 and lasted nine days. However, buying a holiday is very different to clothes or trainers as you're likely to spend much more. Klarna told Which? Money it works with hundreds of travel providers globally, but in the UK, it works with just a handful including Expedia, Flymble and. In total it works with 170,000 merchants worldwide and has joined PayPal on hundreds of online checkouts for fashion, sports, beauty, home and, increasingly, travel retailers. Klarna - which is Swedish for 'clear' - launched in the UK in 2017 and has been forging partnerships with retailers at breakneck speed. Your data will be processed in accordance with our Privacy policy

PAY FOR FLIGHTS WITH KLARNA FREE

This newsletter delivers free money-related content, along with other information about Which? Group products and services.

0 kommentar(er)

0 kommentar(er)